Youtap offers a comprehensive multi-currency travel wallet platform enabling various financial The financial technology (fintech) industry is rapidly evolving, and with it, the way we save and borrow money is changing. eWallet platforms are at the forefront of this revolution, offering innovative solutions that make savings and lending more accessible, efficient, and user-friendly. Let’s take a deep dive into how these platforms are reshaping the financial landscape.

The Rise of eWallet Platforms

eWallet platforms, also known as digital wallets or mobile wallets, are essentially digital versions of traditional wallets. They allow users to store, manage, and transfer money using smartphones or other digital devices. But eWallets are much more than just a tool for payments. They have evolved into comprehensive financial platforms offering various services, including savings, lending, and investment options.

eWallet Features

- Digital Onboarding: eWallet platforms offer a seamless and paperless onboarding process, allowing users to open accounts and access services quickly.

- Payments: Users can make real-time payments to other users or merchants directly from their eWallets.

- Bill Payments: eWallets simplify bill payments by allowing users to schedule and pay bills directly from their accounts.

- Cash Management: Users can track their income and expenses, set budgets, and manage their finances effectively.

- Savings & Loans Products: eWallets offer various savings and loan products tailored to individual needs, such as high-yield savings accounts, fixed deposits, and personal loans.

- Savings & Loans Engine: This feature automates interest calculations, deposit management, and loan origination and collection processes.

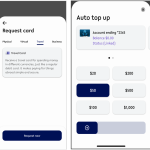

- Card Manager: Users can manage their companion cards, including resetting PINs, locking cards, and requesting physical cards.

Companion Cards

Many eWallet platforms offer companion Visa cards linked to the user’s eWallet account. These cards can be physical or virtual and allow users to:

- Transact Directly from their eWallet Balance: Users can make purchases at any merchant that accepts Visa cards, online or offline, and withdraw cash from ATMs.

- Access Funds Internationally: Companion Visa cards are accepted globally, making it convenient for travelers to access and spend their money in different countries.

Banking as a Service (BaaS)

eWallet platforms often leverage BaaS to provide their services. BaaS is a model where licensed banks integrate their digital banking services into non-bank businesses’ products. This allows fintech companies to offer banking services without needing a banking license.

Key Aspects of BaaS in eWallet Platforms:

- Custodial Account: A trust account where a licensed bank stores the pooled balance on behalf of the eWallet provider.

- API Connection to Banks: eWallet platforms have API connections to banks, enabling seamless and secure transactions.

- Compliance: By partnering with licensed banks, eWallet providers ensure compliance with regulations and standards, including AML and KYC requirements.

Benefits of eWallet Platforms

- Convenience: Users can access financial services anytime, anywhere, directly from their smartphones.

- Accessibility: eWallets cater to a broader audience, including those without access to traditional banking services.

- Efficiency: Transactions are processed quickly and efficiently, with reduced processing times.

- Transparency: Users have a clear view of their transactions and account balances.

- Cost-effectiveness: eWallet platforms often have lower fees than traditional banks.

The Future of Savings and Lending

eWallet platforms are transforming the way we manage our finances. As technology advances and more innovative features are introduced, eWallets will likely play an even more significant role in the future of savings and lending. With their focus on convenience, accessibility, and efficiency, eWallet platforms are empowering users with greater control over their financial well-being.

About Youtap Technology Limited

Youtap Technology Limited is a global leader in providing innovative payment solutions, applications and financial services technology for contactless payments and SuperApps offering a wide range of services within a single app . The company’s comprehensive offerings include payments, marketplace, and fintech platforms designed to transform financial transactions into seamless digital experiences through its white-label SuperApps. With a focus on security, reliability, and user-friendliness, Youtap is enabling businesses and consumers worldwide to tap into the benefits of the digital economy.