Modern banking continues to transcend from the traditional bricks-and-mortar of finance to a digital, invisible presence that does not require a building to do business. This digital transformation has exponentially increased due to pandemic restrictions, subsequently forever changing the face and use of modern banking. Yet, despite this necessary adjustment from physicality to mobility, the Federal Deposit Insurance Corporation (FDIC) reported that as of June 2021, over 6% or 14.1m American adults are unbanked and 1.7b people globally. How can this issue of inclusion be addressed today?

Artificial Intelligence (AI), Big Data Analytics, and rapid, ever-changing Technology are just some of the tools traditional banking uses to create financial inclusion for the unbanked. These platforms have initiated a new paradigm for the banking industry. These emerging, disruptive instruments accommodate those potential clients that have been and continue to be excluded by bricks and mortar of tradition.

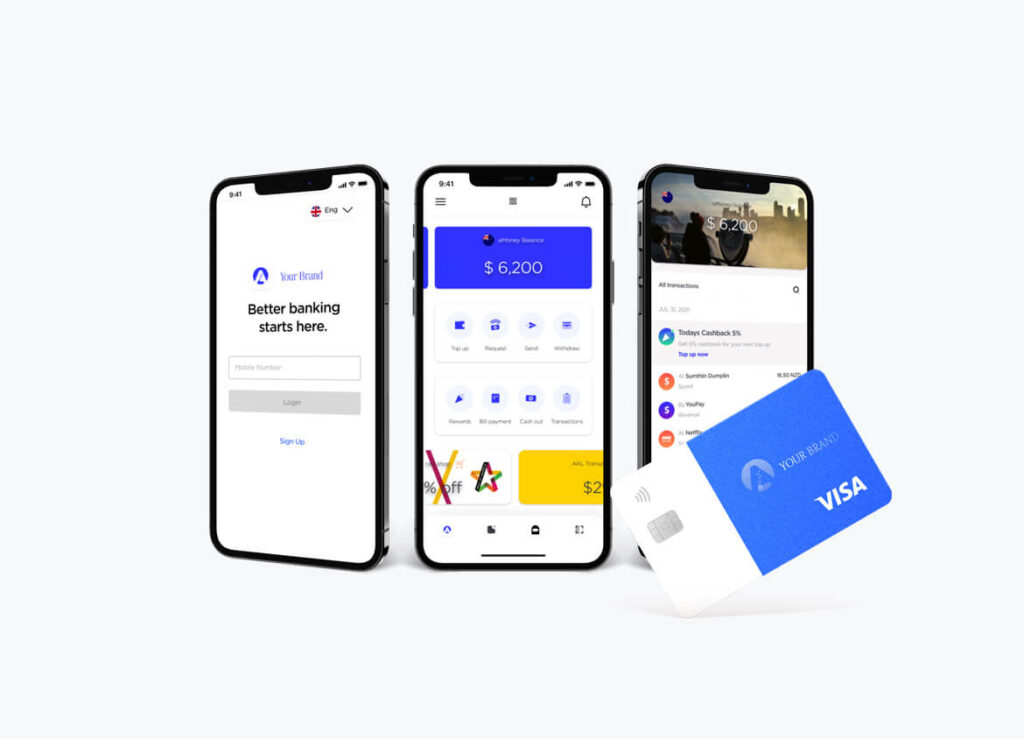

Encouraging financial inclusion is a way to break the cycle of economic exclusion. This process of motivating banking customs to keep up with the accoutrements of modern life is a changing continuum. AI and Technology have realized a proliferation of apps that address the unbanked issue. These applications keep up with unbanked obstacles. Many apps operate without requiring personal identification, credit checks, or previous banking issues. Whatever the unbanked reasoning is behind not having a bank account, applications are starting to enable more of them to become fiscally engaged.

These applications enable banks and financial institutions to provide a range of services to seasonal workers, the underserved, and government departments wishing to manage cash distribution.Digital applications for basic banking, remittance, and cash management provide security, financial management, and peace of mind to this group and, importantly, drive financial inclusion.

The innovations created have usurped historical conventions for modern convenience. The apps are overcoming the challenge by proffering more digital products, providing more relevant economic engagement, with financial freedom that is inclusive within an ever-changing tableau of technological advancement and artificial intelligence. Unfortunately, traditional banks have been slow to adjust. To remain competitive and relevant in a ruthless marketplace, they need to become digitally savvy. Otherwise, the 1.7 billion unbanked and counting will choose an app to give them financial literacy, and banking traditions will become a Brontosaurus, a dinosaur of the modern age.